According to Forbes, the venture capital secondary market is expected to grow significantly, with deal flow projected to exceed $286.3 billion globally by 2025. This significant increase has caused a shift in the industry as investors increasingly seek financial flexibility for their investments in private companies. With startups staying private longer and traditional exit routes like Initial Public Offering (IPOs) becoming less frequent, secondary markets are emerging as a crucial solution to address liquidity challenges.

The lack of liquidity in venture capital has long been a top priority. Early-stage investors, employees, and limited partners often cannot access their invested capital for years, creating funding restrictions and limiting flexibility. For startups, this situation increases the pressure to retain talent and meet investor expectations while continuing their growth journey. The absence of timely exits not only disrupts relationships but also impacts the overall efficiency of the venture capital environment.

Secondary markets provide a much-needed solution by enabling the buying and selling of existing investments in private companies. These markets allow early investors and employees to extract value from assets without waiting for an IPO or acquisition. For example, recent high-profile transactions like Stripe’s secondary sale at a $70 billion valuation illustrate these markets’ increasing influence. Additionally, innovative deal structures such as GP-led continuation funds are helping general partners extend fund duration while offering liquidity to limited partners.

This rise in secondary markets reshapes venture capital by addressing funding difficulties and creating new engagement opportunities. Investors gain flexibility, startups retain talent through equity funding choices, and new buyers access high-growth companies that were previously inaccessible. As deal structures evolve, secondary markets promise to redefine how venture capital operates, making them an essential component of the industry’s future.

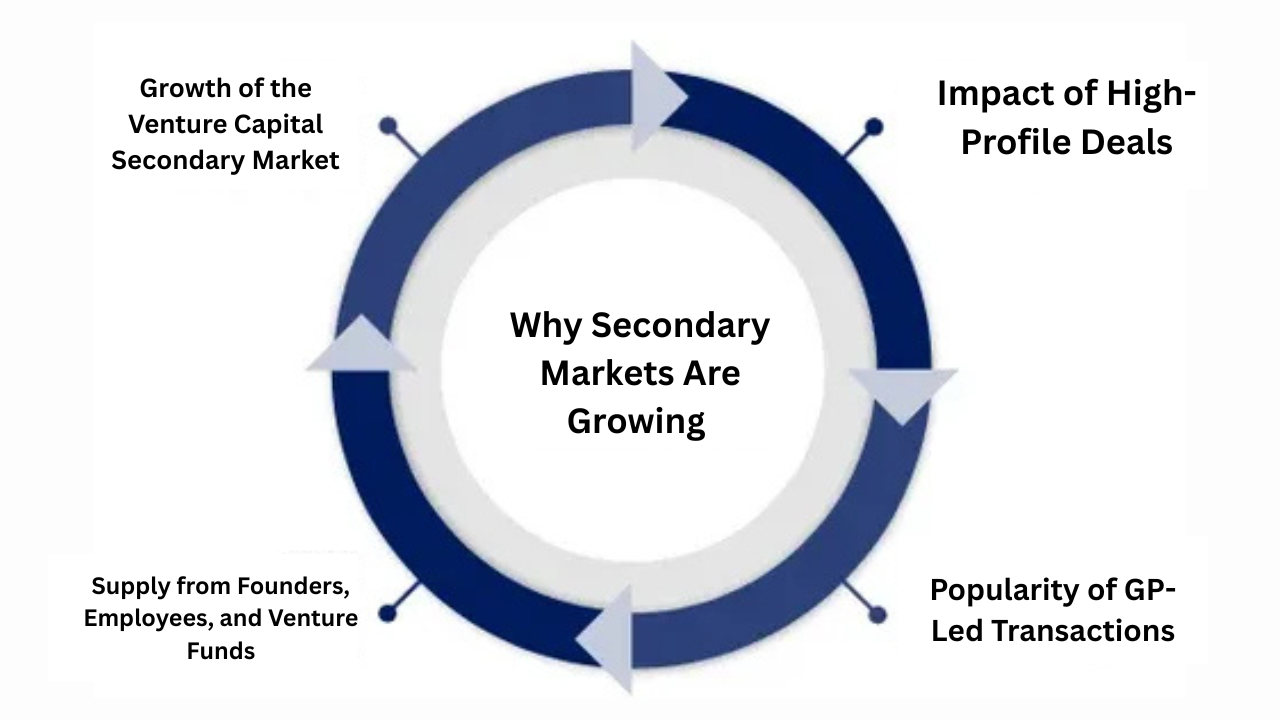

Why Secondary Markets Are Growing

The venture capital secondary market has experienced remarkable growth over the last ten years, sustained by emerging patterns. According to Industry Ventures, the demand exceeded $130 billion in market activity by 2023, with projections indicating continued expansion. One major contributor is the increasing supply of shares from founders, employees, and venture funds pursuing financial flexibility. For instance, direct secondary transactions now account for 1-3% of the venture capital market annually, showcasing the growing fund demand among investors.

Additionally, GP-led transactions have become popular as general partners seek alternatives to extend fund duration or provide liquidity to limited partners. High-profile deals like continuation funds by Lightspeed and Insight Partners illustrate this trend. These transactions address cash requirements and enable funds to restructure portfolios and increase efficiency. Auxin VC supports this process by focusing on strategic investments for development and innovation.

Expanding Buyers and Market Changes

The secondary market has evolved beyond traditional players like growth equity investors and secondary funds. New market players such as family offices, public investment funds, and pension funds are increasingly participating in secondary deals, diversifying the target market and increasing financial flexibility. This expansion is creating opportunities for more significant transactions and increasing market growth.

However, the complexity of secondary transactions is also increasing. Deals often involve multiple parties, sophisticated legal agreements, and diverse securities types. This complexity requires thorough due diligence and negotiation skills, making secondary markets a specialized yet profitable sector for investors. Auxin VC addresses this complexity by providing strategic mentorship and funding to startups to help them guide these challenges effectively.

The Impact on Venture Capital

The rise of secondary markets is fundamentally altering the venture capital environment. With over $4.6 trillion in privately funded startups globally, secondary markets enable investors to unlock capital without waiting for conventional exit strategies like initial public offerings (IPOs) or mergers. This funding advantage early investors support startups by providing employees with share conversion strategies.

Moreover, the growing focus on Environmental, Social, and Governance (ESG) criteria influences secondary market investments. Buyers increasingly prioritize companies with strong ESG practices, aligning financial goals with sustainability objectives. Auxin VC supports this trend by promoting sustainable development and ethical business practices in its investment strategies.

Looking Ahead to the Future

The venture capital secondary market is prepared for continued growth. By 2025, deal flows are expected to exceed $120 billion globally. As startups remain private longer and capital requirements rise, secondary markets will be more critical in shaping investment strategies.

With innovations like portfolio strip sales and hybrid linear programming (LP) models gaining traction, the future of venture capital secondary markets promises exciting opportunities for all investors involved. Auxin VC is prepared to play a significant role by using AI and sustainable technologies to fuel advancements and growth in emerging sectors.

Let’s Wrap It Up

The growing need for funding and evolving investment strategies promote the expansion of the venture capital secondary market. As this market stabilizes, it will significantly impact the venture capital environment by offering new opportunities for investors and startups. This evolution calls for strategic investments and a focus on sustainable growth.

Embracing these trends will create a more resilient and impactful environment. Auxin VC will help support startups in emerging sectors. The venture capital community needs to promote innovation. The combination of these efforts will shape a promising future for all investors.